South Korea Beef Trade Us South Korea Beef Trade Us Tariff

U.S. Agriculture Reaps Benefits of Costless Trade Understanding with Korea

Printer-Friendly PDF

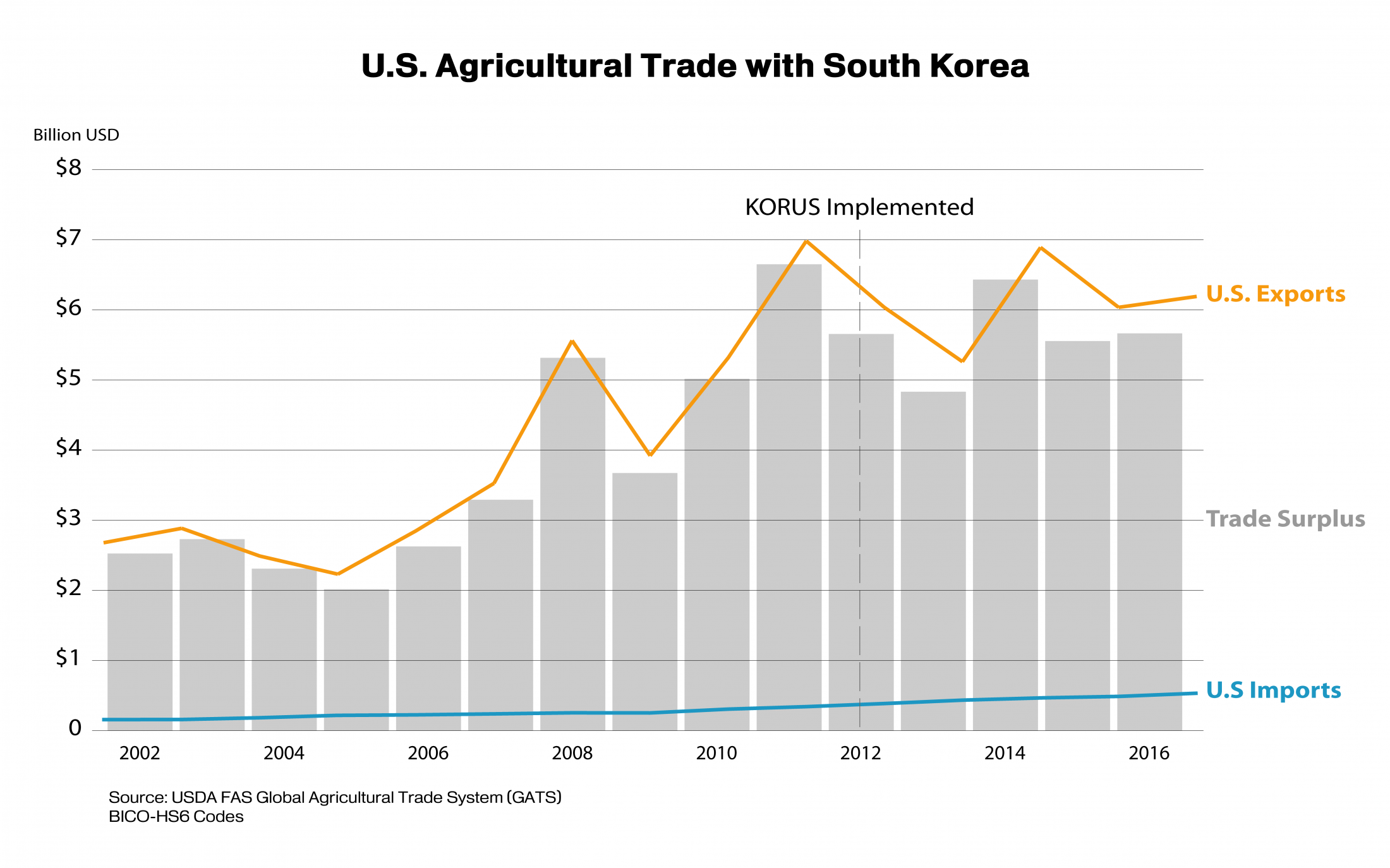

U.S. agronomical exports to South Korea have grown in recent years, largely due to tariff reductions and the lifting of non-tariff barriers. The U.S.-Korea Trade Agreement (KORUS) entered into forcefulness in 2012, immediately removing tariffs on 2-thirds of U.S. farm and food exports to South Korea. Already, the United states' average exports to South Korea have increased from $5.4 billion in the three-twelvemonth menstruation earlier KORUS implementation (2009-2011) to $6.37 billion in the three years post-obit (2014-2016). As additional tariffs are phased out, U.Due south. agricultural exports to Republic of korea volition grow farther.

With a population of 51 million and a growing middle class, South korea continues to be one of the top destinations for U.Southward. agricultural goods, ranking every bit the Us' 6th-largest market in 2016. The Us is South Korea'southward top agricultural supplier, providing 28 pct of the state'southward subcontract imports.

| U.S. Agricultural Trade with South korea | |||

| Agronomical Total | 3-Year Average | Change | |

| 2009-11 | 2014-sixteen | ||

| U.S. Exports to South korea | $v,404 | $half dozen,371 | + 18% |

| U.Due south. Imports from Republic of korea | $290 | $486 | + 68% |

| Trade Balance | $5,114 | $5,884 | + fifteen% |

| Source: USDA FAS Global Agricultural Trade Organisation (GATS) – BICO-HS6 | |||

U.Due south. Export Gains Following KORUS Implementation

When KORUS took effect in 2012, many tariffs immediately fell to zero while the phase-out of others began. For many U.South. exports – including prepared foods, fresh fruits, and distillers grains – the benefits were seen immediately. For instance:

- U.S. prepared nutrient exports to Republic of korea reached $423 million in 2016, upwardly 57 pct from 2011.

- U.Southward. orangish exports were valued at $181 million in 2016, upward 19 pct from 2011.

- U.South. cherry exports reached $104 million in 2016, up 163 percent from 2011.

- U.S. fresh grapes exports reached a tape $27.8 1000000 in 2016, a 102-percent increment from 2011.

- U.S. distillers grains exports reached $176 million in 2016, up 95 per centum compared to 2011.

Benefits Proceed to Grow as Tariffs Phase Out

Due to the cyclical nature of agriculture and its susceptibility to climatic events, pests and disease, U.S. agricultural exports to South korea got off to a ho-hum first in the early years of KORUS. The United states of america' two largest exports, corn and beef, declined in the initial years of implementation for reasons unrelated to the agreement. U.S. corn production suffered from the celebrated 2012-13 drought and, as a effect, U.South. corn exports to the globe savage from 45 million metric tons (MMT) in 2011 to 23 MMT in 2013. After U.S. corn production and exports recovered, U.S. corn regained its competitive border in Republic of korea too, with exports rise 40 percentage, from three.iv MMT in 2015 to four.8 MMT in 2016. U.Due south. corn exports to Korea were valued at $865 million in 2016. Despite improvement in corn exports to Korea, the United states is facing strong competition from South American countries that accept had record harvests in recent years.

In the two years prior to KORUS implementation, U.South. beefiness exports to South Korea soared as the country faced its worst outbreak of foot and mouth disease in history. This led to the alternative of domestic herds and a resulting shortage in domestic product. Coincidently, with the initiation of KORUS, U.Southward. beef exports brutal in 2012 considering Korean herd levels and beefiness product recovered to normal levels. Simply since then, U.Southward. beef has benefited from increased price competitiveness and lower duties thanks to KORUS. Equally a result, U.S. beef and beef product exports to South Korea grew from $806 million in 2015 to $1.1 billion in 2016, an increase of 32 percentage. Beef and beef products remain the top U.S. agricultural exports to South Korea.

South korea Remains a Significant Market

South korea remains a pregnant and expanding market place for many U.S. agricultural exports. For example:

- South Korea is the height market place for U.Due south. fresh oranges. In 2016, 28 percent of all U.Southward. fresh orangish exports were shipped there and the United States held a 95-percent market share.

- Due south Korea is the 2d-largest importer for U.Due south. beef and beef products, behind Japan, with 17 percent of total U.S. beefiness exports destined there in 2016.

- Republic of korea is the top destination for U.Due south. fresh cheese. In 2016, 31 percent of all U.Southward. fresh cheese exports went to Korea, where the The states holds a 45-percent market share.

Imports of consumer-oriented U.S. products are forecast to remain potent every bit South Korean consumers continue to demand value, quality, and diversity.

| Top U.South. Agricultural Exports to South Korea | ||||||

| Product | Value (million United states) | Rank Among | ||||

| 2012 | 2013 | 2014 | 2015 | 2016 | ||

| Total Agronomical Exports | $6,032.9 | $5,257.four | $half dozen,889.0 | $6,033.half-dozen | $half dozen,189.4 | sixth |

| one. Beef & Beefiness Products | $575.ix | $604.eight | $844.ane | $805.9 | $1,064.six | 2d |

| 2. Corn | $618.iii | $243.4 | $ane,055.6 | $655.0 | $869.four | tertiary |

| 3. Prepared Foods | $272.8 | $325.three | $337.8 | $366.8 | 423.5 | 4th |

| 4. Fresh Fruitone | $369.seven | $356.one | $347.1 | $374.2 | 389.1 | third |

| Oranges | $216.1 | $190.1 | $130.9 | $160.8 | 180.5 | 1st |

| Cherries | $73.vi | $81.five | $114.ix | $102.0 | 104.nine | 2d |

| Fresh Grapes | $16.four | $17.7 | $24.v | $xvi.6 | 27.8 | 9th |

| 5. Pork & Pork Products | $409.ix | $262.8 | $431.iii | $466.eight | 359.8 | fifth |

| half-dozen. Tree Basics1 | $253.5 | $300.six | $362.0 | $355.4 | 297.7 | 9th |

| Almonds, No Shell | $120.seven | $157.5 | $204.0 | $179.9 | 164.half dozen | sixth |

| Walnuts, No Shell | $105.v | $100.2 | $120.vi | $112.4 | 93.4 | 3rd |

| Nuts, Seed Prep | $9.7 | $11.5 | $15.9 | $43.two | 18.7 | eighth |

| seven. Hides & Skins | $573.8 | $485.8 | $449.3 | $366.0 | 286.ii | 2nd |

| 8. Wheat | $645.three | $340.3 | $412.5 | $309.2 | 248.i | 7th |

| 9. Hay | $234.ane | $234.two | $223.1 | $262.2 | 235.6 | tertiary |

| 10. Dairy Products1 | $223.ii | $298.ix | $409.3 | $303.9 | 230.four | 4th |

| Fresh Cheese | $61.half-dozen | $127.2 | $198.9 | $146.8 | 105.4 | 1st |

| Cheese exc. Fresh | $60.1 | $33.7 | $62.three | $42.3 | 26.ix | 4th |

| Processed Cheese | $16.ane | $23.i | $23.iv | $23.iv | 22.7 | 1st |

| Source: USDA FAS GATS – BICO-HS6 | ||||||

Looking Frontward: Korea Has 15 FTAs and Is Negotiating More

Since the conclusion of the Uruguay Round negotiations in 1994, South korea has been actively pursuing gratis trade agreements (FTAs). To date, the country has FTAs in force with Chile, Singapore, the European Gratuitous Trade Clan, the Association of southeast asian nations (ASEAN), India, the European union, Peru, the United States, Turkey, Australia, Canada, China, New Zealand, Vietnam, and Colombia. Currently, South Korea is revising its existing agreements with Association of southeast asian nations, India, and Republic of chile.

South Korea is also in negotiations for ten boosted multilateral and bilateral FTAs: with the 16-country Regional Comprehensive Economical Partnership (or RCEP), economical integration with both China and with Japan, with a grouping of vi countries in Central America, and with Nippon, the Eurasian Economical Union, the Gulf Cooperation Quango, Republic of indonesia, United mexican states, Ecuador, and Israel.

Fifty-fifty though South Korea has numerous FTAs in force, the United States withal enjoys preferential treatment in the South Korean market place. However, as Korea continues to sign new FTAs, the U.S. will lose much of the tariff advantage it currently enjoys. Without the KORUS agreement, the Usa would face up college duties than many of its competitors.

Southward Korea Recently Reopened to U.Southward. Poultry

In August 2017, USDA announced that Southward Korea lifted its ban on U.S. poultry after an outbreak of highly pathogenic avian influenza (HPAI) was reported in Tennessee in March 2017. South korea has experienced several recent outbreaks of HPAI, increasing its reliance on imports to avert market disruption. All the same, Republic of korea's policy of placing nationwide bans on poultry coming from countries experiencing HPAI outbreaks has hampered U.S. exports to South korea in recent years. U.Due south. chicken exports to South Korea dropped 89 per centum between the 2014 and 2016 marketing years, from 64,937 metric tons (MT) to only 7,110 MT (link). For any time to come outbreaks, the United States has been working with Due south Korea to accomplish an agreement on HPAI regionalization. Regionalization would but preclude exports from a U.S. country with HPAI rather than the entire country. This agreement would ensure that U.S. poultry exports to South korea remain uninterrupted.

The recent lifting of the ban provides an opportunity for increased U.S. exports. Farther, poultry consumption in Republic of korea is expected to grow due to several upcoming international sporting events. The S Korean chicken industry reports a five-per centum increase in craven consumption during big sporting events both within and outside the country. Non merely is South Korea hosting the winter Olympic Games in February 2018, only poultry consumption should also increment as Koreans spend time at home watching the men'due south soccer World Cup in Russia in June 2018 and the Asian Games in Republic of indonesia in August 2018.

U.South. Agriculture Relies on Tariff Reductions to Stay Competitive

Pinnacle U.South. agricultural exports to Southward Korea accept benefited from the tariff reductions set by KORUS, giving U.Southward. exporters a competitive edge. For instance, U.Due south. beef and beefiness products faced a forty pct tariff rate before KORUS, merely that will gradually stage out over xv years. In 2017, the current applicable tariff on U.Southward. beef is down to 24 percent (link). Meanwhile, Korea's tariffs on Australian and Canadian beef are 29.3 percent and 32 percent, respectively. While Australia and Canada volition as well see their beef tariffs phased out, the United States has had a head start and volition go on to have the lowest beefiness tariffs compared to Australia and Canada for a decade.

For fresh oranges, the United States maintains its dominant position with a favorable FTA duty rate of five percent in 2017. U.S. pork exports will continue to compete with Eu pork in 2017, largely due to lower FTA tariff rates. The EU is the second-largest pork supplier to South korea, after the Usa. Other subcategories, such every bit poultry products, take dissimilar tariff reduction schedules. For instance, South Korea's twenty-percent tariff on imports in the dominant frozen leg quarter category will be phased out past 2021. Additionally, tariffs on U.S. exports of frozen breasts and wings to South korea will be eliminated past 2023.

Other exports, such as fresh cheese, fall under the tariff rate quota (TRQ) system. Currently, U.S. goods tin enter South Korea duty-free up to the maximum book permitted by the quota, with a duty charged on exports higher up the quota. Nevertheless, based on the KORUS agreement, the tariff on U.S. fresh cheese will be phased out in 15 years and all U.S. cheese will enter Southward Korea duty-gratuitous past 2026.

South Korea Tariff Schedules Before and Later on KORUS | |||

| Top U.Southward. Agricultural Exports | Staging | Pre-KORUS Tariff | Post-KORUS Tariff |

| 1. Beef & Beef Products | Twelvemonth 15, Safeguard | 40% | 24% 1, 3 / 0% (in 2027) |

| 2. Corn | Immediate | 328%6 | 0% |

| 3. Prepared Foods | Varies | Varies | Varies |

| four. Fresh Fruit5 | |||

| Oranges | Year 7ii | 50% | 5%2 |

| Cherries | Immediate | 24% | 0% |

| Fresh Grapes | Year 17 | 45% | xiv.5%1 / 0% (in 2028) |

| 5. Pork & Pork Products | Year 3 | 22.5% | 0% |

| 6. Tree Nuts5 | |||

| Almonds, Shelled | Immediate | 8% | 0% |

| Walnuts | Twelvemonth half-dozen | 30% | 0%1 |

| Nuts, Seed Prep | Twelvemonth 10 | 45% | 18%i / 0% (2021) |

| 7. Hides & Skins | Varies | Mostly 0% | |

| 8. Wheat | Immediate | 1.8 - 3% | 0% |

| 9. Hay | Varies | xviii.5 – 100.five% | Varies |

| 10. Dairy Products5 | |||

| Fresh Cheese | Year xv, TRQ | 36% | 21.6%1,4 / 0% (in 2026) |

| Cheese exc. Fresh | Yr 15, TRQ | 36% | 21.6%1,4/ 0% (in 2026) |

| Processed Cheese | Year 15, TRQ | 36% | 21.6%1,4 / 0% (in 2026) |

| Source: USDA-FAS Agronomical Tariff Tracker and USDA-FAS GATS – BICO-HS6 | |||

| ane Present (2017) | |||

Source: https://www.fas.usda.gov/data/us-agriculture-reaps-benefits-free-trade-agreement-korea

0 Response to "South Korea Beef Trade Us South Korea Beef Trade Us Tariff"

Post a Comment